This EIP originally was written like others, but I found that using English to try to sufficiently specify this proved to be way too hard. By the time it was sufficiently specified, I had essentially developed a new DSL that people had to learn. It was much easier to understand by just writing it using a sufficiently specific language that many people already are familiar with and is well documented and can be directly tested.

With 1559 being implemented would it be possible to have the block reward increased back to 3 per block to compromise the fee’s being burnt? Miners have played a huge part in ethereum yet they’re being punished. Burning the fee’s is a positive for traders ect but I think increasing the block reward would be a win win for miners and holders of ethereum. Just my opinion on the matter.

A separate issue with EIP-1559 is that it does not seem to be tested/simulated/analyzed under realistic network conditions.

So we do not know exactly how the formula will behave. We only have a theoretical hypothesis scarcely supported by evidence.

What we need is more testing and analysis comparing different options

This is being done right now, see “Client Updates” here.

IMHO is it a very meaningful thing to do. In particular, it is interesting how tweaking different constants in the formulas can affect results…

An interesting possibility is to start with 1% of blocks using the new system, and then add one 1% say each week, while the rest using the old system. In this way, the experience can be slowly gained …

We decided against that because it was hard to estimate how long the transition should be. Instead, we’re always going to allow legacy transactions, and just have clients interpret them as FEE CAP = GAS PRICE and TIP = GAS PRICE - BASE FEE. This means projects/wallets/etc, don’t have to update if they don’t want to, but their transactions will be less gas-efficient.

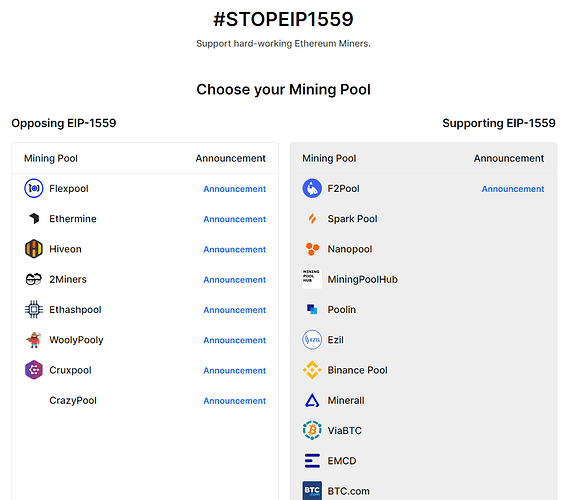

Ethermine - 22.7%

Hiveon - 4.4%

2Miners - 3.5%

Flexpool - 0.5%

Ethashpool - 0.4%

WooolPooly - 0.3%

Cruxpool - 0.5%

CrazyPool - 0.4%

Total Network Miners Against 1559 = 32.7%

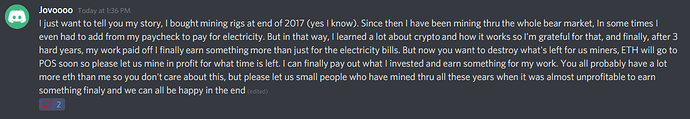

And yet here we are trying to stop the newest community arrival (Defi) from literally taking over Ethereum by destroying miners and putting their own people in charge of ACD meetings. We need more peoples stories like this, they break my heart.

When is enough money enough for you guys in Defi? I have plenty and have worked hard to get where I am at, but I still look out for the little guys though because I can relate. Crypto has the potential to change society and put small people back in control of their own finances. This was one of my main drivers for joining the crypto community. Just because you have the money and power does not mean you should use it to step on the people without it to gain more.

We have moved so far away from the founding principals of why Ethereum was started in the first place.

Link below to 1559-mining discord comment. Sadly this guy posted his comment and nobody responded.

I’m glad to see some work attempting to verify the economic assumptions behind this proposal. Unfortunately I haven’t found anything among the simulation notebooks linked there that would be able to answer the question I’ve been asking to myself: Will the imposition of a base fee lead to higher gas prices on the average (compared to the massively simpler alternative of modestly increasing the block gas limit)?

All the simulation work I’ve come across so far focuses on comparing the performance of legacy vs. EIP-1559-aware transaction users in a post-EIP-1559 world, but that doesn’t answer the question of whether the introduction of a base fee in itself is doing any favor to us transaction users on the average, it only tells us that adopting the canonical post-EIP-1559 fee estimation strategy has certain advantages over continuing to send legacy transactions in an EIP-1559 world (which isn’t surprising since legacy users are still required to pay the base fee even though without EIP-1559 they would have been able to bid below it). Some objective comparison between this proposal and the feasible alternatives seems badly needed (Feel free to provide a link if some work has already been done in that area, I’m very interested to see the results).

EIP-1559 put simply:

- Passing Yield Farming Costs onto the rest of the community - It allows Yield Farmers to push the costs of doing thousands of transactions in each block onto the normal users of the blockchain that are just sending coins. This is done by averaging the gas cost over time to prevent a spike in fees that would normally have to be paid by the Yield Farmer. This will just allow them to make more transactions before the costs go up, except once the average goes up they stop and the rest of the community is now paying a very slowly decaying transaction cost. Once it comes back down to a low level Yield Farmers spring back into action again and push it slowly back up. This is different than it is right now and the spikes in fees go up and come down relatively fast and are paid for immediately by the perpetrators.

- Burning the BASEFEE is Pyramid scheme for Yield Famers While it is being sold to be done to prevent miners from manipulating fees, the real reason is to ensure the rise in the BASEFEE due to Yield Farming is used to remove excess Ethereum from the system. This has the effect of reducing Ethereum coins per the coins being farmed in terms of the BASEFEE. IE the farmed coins will be worth more after the BASEFEE is allowed to go back down.

1559 was made to benefit sophisticated computer driven trading systems designed to take advantage of BASEFEE vs Farmed Coins yields that can run thousands of transactions in a single block. This is Wallstreet Flash Traders wanting to change Ethereum so they can do thousands of transactions in a block and pass the majority of the costs onto others while taking the rightful profits away from the miners.

1559 will NOT meaningfully reduce gas prices for end users. This is not a goal of EIP-1559. Gas price reduction comes with either reduced demand for block space (rollups) or increased block space (sharding). EIP-1559 is expected to leave users with approximately the same gas price on average, with maybe a small decrease due to gas pricing efficiency improvements enabled by EIP-1559 (so people no longer over-estimate gas prices).

What he is trying to say is 1559 will only reduce fees for yield farmers that are dumping thousands of transactions into a block and then not pay the extra fees to miners. Additionally if the yield farmers do this for an extended period the fees WILL go up for everyone and then slowly come back down since it is an average over time.

What is also not being told is this change will cause a huge explosion in yield farming and WILL result in higher BASEFEEs as the average goes up and will then establish a new floor and ceiling based solely on farming profitability. Of course the counter argument is there is no way to predict the impact. Bottom line is if something becomes extremely profitable, those who have the resources (systems than can do thousands of transactions per block) will take full advantage of it.

Thank you for stating that clearly, there is plenty of confusion floating around the internet in this regard. May I ask what the practical benefit of this will be to the end user? (to the majority of us unlucky enough to have arrived too late to the party to have had the chance to amass a large quantity of ether that would appreciate significantly from its deflationary effect ![]() )

)

I understand that it will reduce the variance of gas prices (which admittedly has been rather annoying to me during the last few months), but if that comes at the cost of increasing average gas prices in the long run I think I personally prefer to keep the variance, as any frequent enough transaction user probably would, because variance tends to cancel out over time (as in the Law of large numbers), while any increase in the average gas prices would add up over time.

How can imposing a minimum gas price ever lead to a reduction in prices in a competitive market? Isn’t it worth considering the possibility that it might have an effect opposite to the intended, as one would intuitively expect from the imposition of a minimum price? Just so we can avoid unpleasant surprises down the road.

The primary benefit of EIP-1559 is a usability improvement around gas price estimation. Gas price estimation is very hard right now, and after EIP-1559 it becomes significantly easaier (almost trivial). I recommend reading A Tale of Two Pricing Schemes. A User Story | by Micah Zoltu | Coinmonks | Medium for a long winded but illustrative description of the problem and the solution.

It is not expected that EIP-1559 will increase gas costs significantly for users. It may decrease them slightly due to efficiency gains, or it may increase them slightly due to improved ability for people to express marginal utility. We can’t know for sure which way it will go, but we can say with mild confidence that the change will probably be negligible.

I recommend reading the article linked above, or some of the resources found in The State of 1559 🔥 - HackMD for a better answer to this question than I could give in a reply here. ![]()

Really well said.

Also, EIPS 1559 is incredibly contentious and only becoming more so. That makes the proposal itself a threat to Ethereum’s security, if approved.

Thanks for the read. So we can say that EIP-1559 will improve the usability for novice users (except at times of congestion where this pricing scheme degenerates into a first-price auction of miner bribes, similar to the current state of things, as I pointed out above and Tim Roughgarden explains in his article “Transaction Fee Mechanism Design for the Ethereum Blockchain: An Economic Analysis of EIP-1559”), but also potentially increases the total gas cost to us transaction users as a collective (due to the existence of a price floor): It can still be a net loss for the ones of us that have the patience to monitor gas prices, avoid transacting at times of congestion and take the risk of having to resubmit a transaction occasionally.

Wouldn’t we all be better off if the block gas limit was increased slightly instead, since that is guaranteed to reduce gas prices for everyone thanks to the increased supply, even if it means that novice users have to stick to a high-percentile gas estimator in order to get a consistent user experience?

I would love to gain a better understanding of the reasoning behind that. Is there any material in the list of resources you linked above addressing this point in particular?

For all users! I’m what many would call an extremely advanced user, and I still often fail at gas price estimation. Even bots who are doing pending queue monitoring can fail at gas price estimation from time to time.

Even during times of increasing congestion, 1559 improves the UX for any user who isn’t in an extreme hurry to be included. The expectation is that even during times of rapidly increasing congestion, the rate of change of the base fee should be fast enough such that blocks return to “not full” rather quickly. Since users can simply state the maximum fee they are willing to pay, as long as the increasing congestion doesn’t last long enough to drive the base fee past the user’s max fee they’ll still get in, without having to re-submit any transaction.

There is no permanent price floor, only a transient one that reduces itself as necessary. The base fee can go all the way to 0 should Ethereum ever have less demand than block space again (something we have not seen for quite some time).

You can set your maximum fee to whatever your personal limit is and you’ll eventually be included (ignoring pool eviction issues) should the demand for block space ever dip below that (assuming your max inclusion fee is higher than miner opportunity cost for including transactions). This is the same as today.

EIP-1559 does not try to fix gas cost issues. Rollups and sharding are the long term solution to those problems. Other solutions may be possible, but they are unrelated to the problem being solved by EIP-1559.

I don’t believe so. It is expected to be a pretty small effect so I don’t think anyone has devoted much resources to it besides just thinking about it and mentioning it in passing.

Right now, many users use historic fees as their mechanism for setting their gas price. This results in users over-bidding for block space during times of decreasing demand and under-bidding for block space during times of increasing demand. These two situations should approximately cancel each other out over the long run, but it is possible that we’ll see a bigger gain on the way down instead of the way up because users generally want to save money and thus they have a preference for underbidding rather than overbidding.

It is also possible that once we give people the ability to bid their full marginal utility without fear of overpaying, we’ll see people who previously would have bid once, failed, then given up now instead declare a very high marginal utility and eventually get included. Note: This argument is essentially saying that by making Ethereum easier to use, demand for block space on Ethereum may increase. Arguing against it is basically saying, “lets keep Ethereum hard to use in order to discourage people from using it” which tends to not go over very well with investors or product developers. ![]()

For all users! I’m what many would call an extremely advanced user, and I still often fail at gas price estimation. Even bots who are doing pending queue monitoring can fail at gas price estimation from time to time.

One of the most common complaints I’ve heard of the user experience with Ethereum is “transactions are prohibitively expensive”, even more frequently than “the gas oracle messed up and my transaction got stuck”. If this is trading the interests of one group of transaction users in favor of the other it will be worsening their user experience, even if you’re right at the end of the day and it’s only slightly so.

Even during times of increasing congestion, 1559 improves the UX for any user who isn’t in an extreme hurry to be included. The expectation is that even during times of rapidly increasing congestion, the rate of change of the base fee should be fast enough such that blocks return to “not full” rather quickly. Since users can simply state the maximum fee they are willing to pay, as long as the increasing congestion doesn’t last long enough to drive the base fee past the user’s max fee they’ll still get in, without having to re-submit any transaction.

The problem I see here is that there is a necessary trade-off between our ability to take advantage of the doubled block size (which is the one aspect of this proposal I find unquestionably helpful, since it should keep gas prices from skyrocketing as quickly when there is a short-lived surge of demand) and the short-term accuracy of the base fee. Allow the base fee to change too quickly (which yeah is good for usability) and you’ll reduce the timespan over which short surges of demand can be averaged out without the gas price going up to similar levels as it does today. Allow it to change too slowly (which should decrease the frequency of transient spikes in the gas price) and you increase the likelihood of reverting back to a first-price auction of miner bribes (which means clients have to continue dealing with the same difficulties of gas price estimation in order to be ready for such a scenario). Once again we’ve hit a trade-off between the interests of users seeking lower gas prices and the ones preferring an easy-to-use pricing mechanism.

You can set your maximum fee to whatever your personal limit is and you’ll eventually be included (ignoring pool eviction issues) should the demand for block space ever dip below that (assuming your max inclusion fee is higher than miner opportunity cost for including transactions). This is the same as today.

Sure, but the question is whether rational transaction users would be able to take greater advantage of temporary drops of demand without such a smoothly-varying price floor. I think we agree that the existence of a base fee imposes a constraint on how low successful bids can be (the slower the base fee averaging the greater the constraint) without significantly reducing the prices users will have to pay during a period of high demand (unless the base fee averaging is slow enough to allow the double-size block to absorb the spike of demand effectively – Oops another trade-off!). Wouldn’t it be worth examining the possibility of this increased price floor leading to increased gas prices in some quantitative fashion?

EIP-1559 does not try to fix gas cost issues. Rollups and sharding are the long term solution to those problems. Other solutions may be possible, but they are unrelated to the problem being solved by EIP-1559.

I find both problems to be somewhat interconnected because any improvement delivering a reduction in gas prices also has quite some chances of improving the user experience, reducing delays and frequency of stuck transactions – Even if it remains a matter of guesswork to find the correct gas price, simply because it increases the range of gas prices that the user is willing to pay and can successfully make it into the blockchain. Also because it seems to be fairly challenging to come up with a solution for such usability issues that doesn’t address the underlying supply problem and doesn’t make anyone worse off. I wholeheartedly agree that rollups and sharding are the real long-term solutions to those problems (but also, to a large extent, to this problem). I’m excited to see how sharding works out, can’t wait for Ethereum 2.0 to be fully functional ![]()

Tried explaining the rationale for 1559 in an accessible way: Why 1559? - HackMD

Feedback welcome

Hi,

According to all hate to this EIP.

Me as 5.5Gh miner I would like to express my full support.

IMO all pool should support any EIP which may have positive impact on project.

Even if short term profit may hurt still long term profits (not only financial) will be larger.

I personally will move to pool supporting this EIP.