Authors [edit 3rd Apr]: Jerome de Tychey, Dean Eigenmann, Zak Cole

Abstract

Temporary enforcement of a minimum max priority for Type 3 transactions (Blobs) by the validators.

Increase research effort to rapidly change the blob pricing mechanism to dynamically adjust upward when L1 gas is low and vice versa.

Motivation

The Ethereum ecosystem has undergone a fundamental shift in transaction dynamics. As the majority of user activity migrates to L2s, these L2s are now responsible for extracting substantial fees from Ethereum their users, while contributing relatively little back to the Ethereum protocol economically. In many cases, L2s pay less than a dollar in Blob transactions. This discrepancy highlights a growing misalignment between where economic activity is secured and where revenue is captured. Ethereum’s current revenue model, largely dependent on direct user transactions on L1, no longer reflects the dominant usage patterns of the network. To ensure long-term sustainability and alignment, Ethereum must reconsider and evolve its revenue mechanisms to account for this L2-centric activity with L1-security reality.

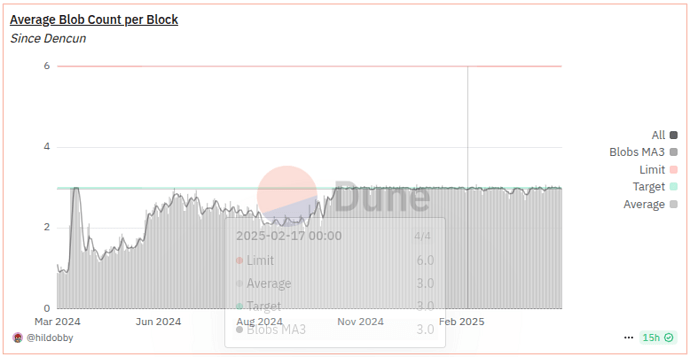

The upcoming Pectra fork adds EIP-7691 (Blob throughput increase) which will double the number of Blobs per block. This will likely reduce further the DA cost of L2 solutions and accelerate the shift in transaction dynamics.

The following proposal acknowledges those challenges. It aims at maximising the security of Ethereum while keeping it decentralized and nudging rollups towards more Ethereum alignment. This proposal is meant to be both voluntarily enforced and temporary until rollups gain in maturity and blob pricing evolves. We note that research discussions have recently started on native rollups with higher alignment with Ethereum, as well as on the blob fees predictability (see EIP-7762 and EIP-7918).

Specification

Ethereum stakers voluntarily enforce a minimum priority fee for Type 3 transactions (Blobs).

Research teams accelerate the ongoing work on dynamic blob gas pricing to target a minimum L1 gas + tip spent (if L1 gas is low, tip is high and vice versa).

Priority fee target computation

Assuming a daily blob gas use of 2.8Bn Gas and a minimum max priority fee 5 Gwei, this proposal would generate 14 ETH daily for the validators (or 5110 ETH yearly ~$10.2M with ETH at $2k).

A “25% Tax” on current L2 onchain revenue could be computed as such: $200M of rollup onchain revenue, 25% is $50M, assuming daily blob gas used of 2.8Bn Gas and ETH at $2k, the minimum max priority fee would be 24.5 Gwei, generating 68.62 ETH daily for the validators (25049 ETH yearly).

Assuming a total current daily validator income of 2639 ETH:

- a 5 Gwei fee would bring the validator daily income to 2653 ETH, ie a 0.53% increase on total daily validator income

- a 24.5 Gwei fee would bring the validator daily income to 2706 ETH, ie a 2.6% increase on total daily validator income