Abstract:

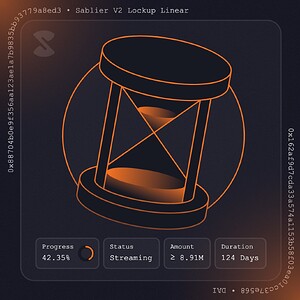

We propose a novel NFT-based flexible token locking system that revolutionizes how token locking and liquidity management are approached in the blockchain space. Unlike traditional locking mechanisms, our system represents locked funds as NFTs, enabling seamless transfer of control to another owner by simply transferring the NFT to a new wallet address. This unique approach opens up innovative use cases, such as ‘vested’ payments to third parties like influencers, where tokens are transferred but remain inaccessible for a specified period or until certain conditions are met.

Key Features:

- Flexible Locking Conditions: Our system supports a variety of locking conditions, including time periods, token price thresholds (using AMMs or Chainlink price feeds), market capitalization limits, token burn thresholds, multisig unlock conditions, and even custom conditions using EventSig to check specific pre-defined conditions on external contracts. These conditions can be combined using AND, OR operators to create sophisticated locking strategies.

- Liquidity Management: One of the most significant applications of our system is in locking liquidity. Project developers can now access a portion of their token’s locked liquidity for pre-approved uses, either through community governance voting or by meeting predefined minimum liquidity requirements. This feature introduces a new level of flexibility and control over locked liquidity that was previously unavailable.

- Easy Lock Info Access: Users can easily check the locking information associated with an NFT by accessing the metadata URL attached to the NFT. This provides transparency and visibility into the locking conditions and status of locked funds.

Conclusion:

Our NFT-based flexible token locking system introduces a paradigm shift in token locking and liquidity management, offering unprecedented flexibility and control to token holders and project developers. We believe that this system has the potential to unlock new possibilities in decentralized finance and token economics, and we welcome feedback and collaboration from the community to further refine and develop this innovative concept.

Discussion Points:

- What are your thoughts on using NFTs to represent locked funds?

- How can flexible token locking systems benefit decentralized finance projects?

- What additional locking conditions or features would you like to see in such a system?

- How can we ensure the security and integrity of locked funds and NFT representations?

- Are there any potential regulatory or compliance challenges associated with this approach?