My apologies for the long post, I’ve hidden part of the post beneath a spoiler tag in the middle. Additionally this text is available in a word format which is considerably easier to read. You can find the document and read it online here: EFRP

Also you’l find an Executive summary right after the introduction. The full proposal text starts a little over halfway under the large header Ethereum Fund Recovery Protocol

Introduction

Self-custody and the complete control it offers users is one of crypto’s greatest strengths. However it also comes at great risk to the individual. One must practice strict crypto due diligence in order to avoid losing funds. Users must keep their private keys safe and secure, preventing both loss and theft, having solid cyber security/awareness is paramount. Additionally users need to be very meticulous when transferring funds, a failed copy paste, typo or even deliberate scam can cause funds to be sent to the wrong address which usually means they are lost forever.

When dealing with smart contracts on the Ethereum network additional smart contract risk comes into play. When a smart contract unexpectedly malfunctions due to an unforeseen interaction/programming error it is the user who risks losing their funds. Since it cannot be expected from users to read/inspect the code of any smart contract it is up to developers to adhere to the highest standards when coding smart contracts. However since developers are only humans mistakes have been and will be made again.

Currently when a catastrophic error does inevitably occur there is no recourse to salvage lost funds and it is the individuals interacting with the smart contract who pay the price.

This additional risk increases the barrier for adoption of smart contract ecosystems like Ethereum and often results in great personal loss. Our aim is to develop an Ethereum Fund Recovery Protocol (EFRP) to mitigate these risks and lower the barriers to adoption of the Ethereum blockchain for regular people and institutions. A single major incident with an institutional user might prevent any further adoption of Ethereum and open the field for other blockchains to fill the gap, which such an incident would create.

The EFRP aims to create a decentralized mechanism by which users who have lost/might lose funds to smart contract malfunction/bugs can regain access to their funds without interfering or sacrificing the immutability of the Ethereum blockchain.

Executive Summary

Ethereum Fund Recovery Protocol (EFRP) proposes a fair, transparent, and decentralized mechanism to assist users who have lost access to their ETH due to smart contract bugs or accidental contract inaccessibility—without resorting to contentious hard forks or centralized decision-making.

Across the Ethereum ecosystem, hundreds of thousands of ETH remain permanently compromised due to unforeseen technical failures, including smart contract vulnerabilities, misuse of the SELFDESTRUCT opcode, and poorly designed upgrade patterns. These issues have impacted a wide array of users—from individuals to DAOs to ICO projects—revealing systemic gaps in safety.

We hope this proposal can redress mechanisms within Ethereum’s current framework reassuring users (retail and institutional) by diminishing smart contract malfunction risk.

Key Features of the EFRP:

sETH Token Mechanism: Eligible users receive a 1:1 token (sETH) that represents their inaccessible ETH. Over time, sETH is redeemed for real ETH via redirected base fees (from EIP-1559), while the corresponding locked ETH is permanently burned and remains inaccessible.

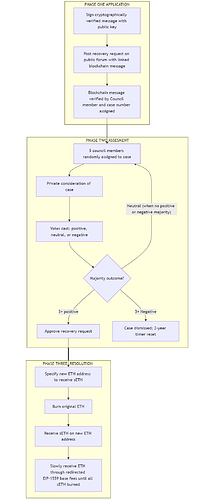

Strict Eligibility Criteria: Incidents caused by verifiable smart contract bugs are eligible. Proof of ownership through private key signatures is mandatory.

Governance via a Technical DAO (The Council): A decentralized 15-member council of Ethereum experts reviews each case in private, ensuring consistent and unbiased application of rules. Cases require cryptographic verification and full transparency.

No Hard Forks or Protocol Changes Required: The system maintains Ethereum’s core principle of immutability. The recovery mechanism operates independently of Ethereum protocol changes and consensus rules. It functions entirely through smart contracts and community governance without altering the core Ethereum protocol.

Transparent, Publicly Auditable Operations: All Council decisions, compensation, and sETH distributions are recorded on-chain for full community scrutiny.

Fully respects immutability of the ETH blockchain: The EFRP does not require any past transactions to be undone or altering any contract that exists on the blockchain thereby fully respecting immutability.

Benefits:

Lowers barriers of adoption for ETH based smart contracts by diminishing smart contract malfunction risk for individual and institutional users.

Respects immutability by burning inaccessible ETH

Provides relief to users affected by smart contract flaws, not user error

Prevents ad-hoc recovery attempts that fragment community consensus

Establishes a precedent for responsible governance of smart contract risk

Ethereum Fund Recovery Protocol is a decentralized, rule-based system of accountability and fairness. It preserves economic neutrality while extending Ethereum’s resilience. This proposal seeks community feedback and support to shape a future where contract safety and immutability can coexist.

Ethereum Fund Recovery Protocol Context

Disclaimer: We are small group of individual early ETH adopters, that helped grow the protocol at its inception who are united by a common personal tragedy in the “Parity wallet bug” that occurred on November 6th 2017. We are not affiliated with Parity in any shape or form nor have we been in direct contact with them. We are however all stakeholders in this event that has resulted in us losing access to our ETH for over 7 years.

We are undertaking this endeavor not to demand or claim anything from either Parity, ETH developers or the ETH community at large. It is our hope that we can have a public discussion about possible solutions for our situation, not just for ourselves but also for others who have found themselves in a similar unfortunate situation and for possible future situations that may occur.

We do not want a contentious EIP, we do not want to create drama or divisiveness within the ETH community, we do not want a simple bailout just for ourselves. What we do want is to have a public discourse after all these years about our situation and others like it to assess if there is a way we as a community can come together and create a possible solution to strengthen the ETH protocol. Should there be an agreed way forward then we view this as strengthening the ETH protocol as a whole and providing an opportunity to end the discussion if such a mechanism should exist. Additionally we believe that such a mechanism could greatly assist adoption of the ETH blockchain by significantly lowering smart contract risk to individual and institutional users.

The context and controversy

The topic of fund recovery and hard forking is incredibly sensitive within the ETH community and for good reason. The nature of fund recovery, especially when performed via a hard fork, but also to a lesser degree a soft fork, infringes on one of the most important fundamental aspects of the blockchain itself, immutability. Ethereum went through its most existential crisis to date over the DAO Hack and subsequent hard-fork that occurred on June 17, 2016.

I’ve hidden more context beneath this spoiler tag.

Historical Context

The DAO hack

In April 2016 in Ethereum’s early days an ambitious project was launched simply named the DAO. The project was a first of its kind and saw a massive influx of ETH holders invest their ETH into this exciting new project, within 28 days the crowd sale raised around 11.5 million ETH. Nearly 14% of all ETH tokens issued at the time. Unfortunately despite several security concerns raised in May a hacker exploited vulnerabilities in the DAO smart contract. On June 17th the DAO contract was drained of 3.6 million ETH to a sub contract controlled by the hacker where they couldn’t be moved from for 34 days. After this holding period the attacker could have withdrawn the ETH completely.

In the weeks that followed Ethereum went through an existential crisis over how to handle the situation at hand. Eventually Ethereum hard forked to move the DAO funds to a recovery address where DAO investors could swap their DAO tokens back to ETH. The controversy cannot be understated, to this day there are news articles about what happened and both proponents and opponents still have discussions about whether the right call was made.

A minority of ETH users continued to support the original non forked chain which spawned the birth of Ethereum Classic (ETC). To this day ETC exists and while only valued at about 1% of the current ETH network it shows how contentious this hard fork was and still is.

The solution to the DAO hack was EIP-779 and this was implemented as an Ethereum hard fork. This was decided at a period before any formal Ethereum governance structure existed early in Ethereum’s development. The system used was community debate and carbonvoting. Carbonvoting required Ethereum to be sent to a specific address to express their stance on the proposal (pro fork or anti fork). Whilst there was strong support for the fork (87% in favor) there was discussion surrounding the limitations of the vote including limited participation and wealth-based influence. Nonetheless the split acted as a catalyst for governance innovation on the Ethereum network leading to future developments like on-chain governance and Decentralised Autonomous Organisations with more secure frameworks.

Having been a part of the ETH community at the time and living through it ourselves we are also still conflicted about the situation. We do feel some of the controversy was made worse by certain blockchain communities being hostile towards Ethereum and fanning the flames so to speak, while jumping on the bandwagon to damage Ethereum. On the other hand, not acting would have led to an enormous amount of people within the ETH community losing their investment and an unknown black hat hacker gaining a significant stake in the ETH network. Intervention was maybe the lesser of two evils, and undoubtedly resulted in improved governance frameworks on the network, the trauma however of this contentious hard fork still lives on.

The Parity wallet hack and freeze

Roughly one year later Ethereum had its second largest high profile hack/bug. On July 19, 2017 a user accidently triggered a vulnerability that was found in the Parity Wallet 1.5 which was released on January 19, 2017. The vulnerability was only in Parity’s “enhanced” multi-sig contract.

An unknown hacker moved quickly and used the vulnerability to hack 3 multisig wallets for about 153,000 ETH belonging to three ETH based projects. Affected were Swarm City (44,055 ETH), Edgeless (26,793 ETH) and Æternity (82,189 ETH). Luckily due to these projects quickly sounding the alarm a group of White Hat hackers from the ETH development community managed to exploit the same vulnerability and drain all other vulnerable multi-sig wallets. This swift action resulted in them saving about 377,000 ETH which were returned by the group to their rightful owners.

Parity was also made aware and put out an emergency message the night of July 19th. They urged everyone who still had funds in the parity multi-sig wallet 1.5 or higher to immediately move their funds to a secure address. The following day the 20th of July Parity released an update to their wallet software. Quote: “UPDATE (20/07/17, 00:26 CEST): Multi-sig wallets created in Parity Wallet after 19/07/17 23:14:56 CEST are secure.”

Unfortunately we know what happened after this. Three months after the Parity hack and emergency contract re-deployment another incident occurred. An anonymous user found an uninitialized wallet related to Parity and initialized it thereby making themselves the sole owner. They then executed the kill function (Opcode: SELFDESTRUCT) and deleted the wallet from existence. This wallet was the library upon which all parity multi-sig wallets created since 20th of July 2017 relied upon to function. The result, all these wallets lost their functionality thereby effectively freezing the ETH stored within them. A total of 513,774 ETH was frozen and remains inaccessible.

Parity

Understandably Parity has received a ton of criticism, animosity and even hate from the community since the multi-sig wallet hack and subsequent bug/freeze. Seeing as the coding mistakes were obvious in hindsight this is understandable but everything is always easy in hindsight. We also feel that the way they subsequently handled the situation after it occurred was terrible. They should have come forward to the community straight away in an open transparent manner to have a public discourse about the most appropriate way to handle the situation. Rather than forcefully proposing EIPs and seemingly attempting to push them through without community consensus, they should have engaged in open discourse with the broader community, respecting all voices and opinions.

However, despite being direct victims of the wallet freeze we do want to break a lance for Parity.

Parity was founded by Gavin Wood who was one of the co-founders of Ethereum. At the time he willingly split off from the foundation he helped to create in order to reduce the foundations burn rate and found Parity. The aim to establish Parity was to keep supporting/building Ethereum and they have done so since the beginning.

Any developer who has worked with Ethereum for a long time will note Parity’s early contributions as significant and critical, tech stack substrate, ewasm smart contracts, light client etc. The Parity Ethereum code base had been running for more than 2 years to support the Ethereum network all free of charge and all open source.

Most notably the Parity client single handedly kept the Ethereum network up and running during the DoS spam attacks that occurred during DevCon 2 in Shanghai. It’s importance cannot be understated and in general the Parity client was loved and used by many in the Ethereum community.

While being a relatively small group with limited funds developing free, open-source software for Ethereum, Parity has, despite their best efforts, made unfortunate and costly mistakes that have resulted in significant losses of ETH for others.

The victims

We think it’s really important to get a very common misconception out of the way here. There seem to be a lot of people who think that Parity themselves were the biggest victim of the wallet freeze. Subsequently a lot of people feel it is the price they pay for their own coding mistakes.

Parity the company nor the individuals working for Parity did not lose a single ETH themselves.

Any solution to this problem would not bail out Parity or any individual who worked at Parity. We are talking about 598 wallets which are impacted. Of these wallets 16 belong to ICO’s most notably Polkadot (306,276 ETH) and ICONOMI (114,939) for a total of 474,830 ETH and an additional 38,944 ETH belonging to individual wallets.

Now many will say that Parity = Polkadot but that is definitely incorrect. Yes, while some people are involved with both Parity and Polkadot they are distinctly not the same entity. The funds that were lost were not funds from the company Parity who invested in Polkadot, instead they were funds from individual ETH investors that choose to invest in a new blockchain.

It is these individual investors who are the real victims; it was ultimately their ETH that was compromised. It is the same case for ICONOMI and the other ICO’s. Due to the freeze, their investments lost significant value as they missed a large portion of ICO-funded treasuries. Even worse, some ICOs lost all their funds and collapsed, leaving investors completely deprived of their investments.

Ultimately neither Parity nor the individuals behind Parity lost anything. It was individual ICO investors or unlucky individuals that used the Parity multi sig wallet that lost their ETH and paid the price for Parity’s coding mistake.

Crypto due diligence

Another frequently repeated criticism concerns crypto due diligence. Many argue that using the Parity wallet reflected poor due diligence, especially since the multi-signature wallet had already been hacked a few months earlier. Therefore, some believe the victims have no one but themselves to blame. But is that really the case?

First of all it assumes that there were plenty of other wallet storage options, however there were in fact only a handful of clients at the time, with the 2 biggest by far being Geth and Parity.

At the time the parity wallet accounted for approximately 1/4 to 1/3 of all Ethereum storage wallets being used, being the second most used wallet after Geth. If this bug also affected the regular Parity wallet instead of only the multi-sig would all those additional victims also have deserved it too due to lack of due diligence? The irony here is that multi-sig wallets are considered one of the safest options, especially for shared custody or institutional use.

By 2017, Parity Technologies had a reputation as a leader in Ethereum infrastructure, thanks to its high-performance client written in Rust—a language valued for its memory safety and efficiency. For years, Parity’s client had been battle-tested under real-world conditions, earning widespread adoption among enterprises and developers. Its stability and scalability stood in stark contrast to Geth, Ethereum’s dominant client at the time, which struggled with memory leaks and outages during network stress tests like DoS/spam attacks. Parity’s reliability was no accident: it was a mature, purpose-built system that had evolved over years of rigorous optimization, not an experimental project.

However, this reputation masked a critical vulnerability elsewhere in Parity’s ecosystem: its smart contracts. While the core client code was robust, the multi-signature wallet contracts Parity offered as optional tools lacked the same rigor. At the time, Ethereum’s ecosystem was still maturing, and practices like comprehensive audits and formal verification—now industry standards—were inconsistently applied. This gap proved catastrophic when flaws in Parity’s contract code led to two high-profile incidents in 2017, freezing and draining millions of dollars in ETH. The disconnect between the client’s reliability and the contracts’ fragility underscored a broader lesson: even proven infrastructure providers are not immune to risks in adjacent systems, especially in a rapidly evolving technological landscape.

The question of Crypto due diligence is in fact a challenging one. Let’s be clear it should certainly entail keeping your private keys secured, not sending funds to the wrong address, verifying what crypto to invest in, diligent internet safety to avoid getting hacked/fished. However, how much responsibility should fall on users vs. developers/ecosystems in a trust-minimized but highly technical environment? Individual users cannot realistically be expected to audit the code of major clients like Parity (or even smart contracts they interact with) as even experts struggle with this.

The logical conclusion is that the ETH lost to Parity’s bugs wasn’t purely “bad luck” it was a failure of processes in an immature system.

A lack of industry-wide safety standards.

Overreliance on reputational heuristics (“Parity = Gavin Wood = safe”).

Poorly designed contract architecture (e.g., shared libraries with no recovery mechanisms).

Today, such a failure would still be possible, but much less likely. The ecosystem now prioritizes audits, formal verification, and defensive coding patterns (e.g., OpenZeppelin standards).

Blaming users for not auditing Parity’s code is unreasonable. Blaming only Parity oversimplifies the problem. The losses were a symptom of a young ecosystem learning through catastrophic failures which is a pattern seen in many emerging technologies. It is highly likely if today’s OpenZepplin’s standards had been used the Parity freeze would not have occurred. It is also true that these standards evolved due to incidents just like the Parity wallet freeze.

However such incidents contribute to the barrier of adoption facing a new and emerging ecosystem like Ethereum. If there is no recourse for individual users when developers make such critical mistakes how can we expect them to adopt smart contracts and increase adoption? Since it is clearly impossible for individual users to verify smart contract code themselves and obviously we don’t want to hold developers financially responsible for unexpected smart contract malfunctions (who in their right mind would keep developing if the risk was that high?) a recovery mechanism is needed.

Moral obligation

Currently within the Ethereum ecosystem there essentially only exists governance by majority decision. While this creates an environment of strong cooperation between high level participants who help program and design the ecosystem it can drown out individual voices. Although the DAO hack was an outlier due to its sheer size of affected users, in general users affected by smart contract bugs/malfunctions are essentially always a small affected minority. There is no constitution or court that this minority can appeal to in case their legitimate ownership of ETH is compromised.

An decentralized recovery mechanism could help protect the rights of individual users and institutions that have been affected by unfortunate smart contract malfunctions. In the case of the Parity wallet freeze it is a small group of early adopters whose contribution helped grow Ethereum in its early days who now depend on the late unaffected minority to help them regain access to their funds. Do we not have a moral obligation to ensure everyone’s legitimate ownership of their own ETH is safeguarded without having to rely on a large unaffected majority to decide on the fate of the small affected minority?

The reality is that if 60% of ETH users were affected by the wallet freeze an intervention would have happened a long time ago. Yet due to the affected users being a small minority they are left to dry and have lost access to their legitimate funds for over 7 years. This is a form of two-tier justice that is highly undesirable

There is a bittersweet irony here where one of the core fundamentals of blockchain is complete ownership over your own funds. No central authority can take your funds away from you, freeze them or prevent you from sending them anywhere. Yet they can be compromised when interacting with a legitimate smart contract causing you to lose complete control and the only recourse is to appeal to a large unaffected majority for help.

Considerations

From previous discussions it is very clear that any solution should be a solution for all ETH compromised not just those in the Parity wallet freeze. We strongly agree with this sentiment, so the aim is to establish a general Ethereum Fund Recovery Protocol (EFRP) that is open to anyone no matter how big or how small, no matter how well or ill connected they are.

One of the problems with trying to establish a technical solution, for example, a protocol upgrade (let’s say a general protocol smart contract revival EIP to restore Parity wallet functionality), is the potential for a whole slew of unintended side effects on other contracts that had not been taken into consideration. On top of that, such a solution would still only resolve lost ETH due to those specific circumstances (in the case of Parity, a killed contract) and does not solve the situation of ETH compromised in different ways. So, a general protocol upgrade (like the ability to revive killed contracts) seems out of the question as it is too risky, too specific and is generally unwanted. Protocol upgrades should be driven by systemic improvements and rigorously evaluated through Ethereum’s established EIP framework, rather than tailored to retroactively address isolated failures like compromised funds due to smart contract malfunctions.

Although specific cases like the Parity wallet freeze might trigger discussions about certain parts of the ETH protocol (like the Pragmatic destruction of SELFDESTRUCT, quote: “The only opcode that breaks the code immutability invariant and indeed, was responsible for the demise of the Parity multisig is… SELFDESTRUCT.”) and eventually lead to protocol upgrades. Discussions regarding protocol upgrades should be held on their own, not in light of ETH recovery. Protocol upgrades should not be mixed or burdened by the discussion regarding specific ETH recoveries. Rather ETH recovery should be discussed entirely on its own in isolation of protocol upgrades.

Potential Solution

To safeguard Ethereum’s future, solutions must prioritize proactive resilience over reactive fixes. This means embedding safeguards into the protocol’s design while rigorously upholding immutability and decentralization.

If protocol upgrades are not possible to release individually compromised ETH incidents, where the issue is related to smart contract code error rather than at the Ethereum protocol level, how can they be recovered? The most obvious answer is also highly contentious, and this is a hard fork through a form of governance. However, there seems to be a very strong opposition to any hard forks to help release ETH in lost contracts. The concern is centered around the breach of immutability of the chain and that it will set a dangerous precedent that will lead to endless hardforks. Also there is fear this will lead to more centralization and pressure from outside of the ETH community to hard fork based on the whims of the powers that be. The opposition seems not necessarily against helping those with ETH that becomes compromised but against using hard forks to do so. Clearly there are good arguments against using hard forks. So how can we still help those with compromised ETH without using hard forks or protocol upgrades to regain lost ETH?

An alternative could be to create and distribute a new “Saved ETH” recovery token, let’s call it sETH, to those affected. This token is a 1 : 1 relation to the compromised ETH. When successfully calling upon the Ethereum Fund Recovery Protocol (abbreviated EFRP) those calling for help accept sETH instead of their compromised ETH and their original ETH is to be forever burned afterwards.

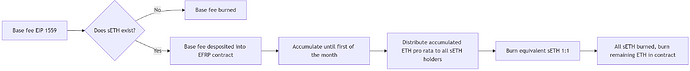

The point of the sETH token is that it will slowly be burned and replaced with actual ETH, we propose to use the ETH base fee that is currently being burned since EIP 1559 for this purpose. So over time those holding sETH will slowly see their sETH burned and replaced with actual ETH thereby making them whole again. If no sETH exists the base fee will completely be burned exactly as is currently the case.

Once sETH is accepted the original ETH that is currently compromised is forever burned so despite the base fee being temporarily distributed to sETH holders an equivalent amount of compromised ETH will be burned in advance. There is a degree of economic logic to this, in that compromised ETH will be permanently burnt completely removing it from the ecosystem therefore the actual ETH burn rate will not be affected and there will be 0 inflation because of the EFRP.

We believe that such a recovery protocol could see thousands of users ultimately regain access to their compromised ETH without hard forking for every instance of recovery. The core principle of the protocol is ownership over accessibility.

Normally holding the private key demonstrates both ownership and accessibility on the blockchain. The protocol is designed for those fringe cases where users still hold the private key and thereby can definitively prove ownership but somehow have lost accessibility to the funds in question.

Immutability is often heralded as the main reason any form of ETH fund recovery cannot be done through a hard fork as this would infringe upon this basic principle of the Ethereum blockchain. So our proposal is a way to move forward to still help out the thousands of users who currently have ETH tokens stuck in limbo and those in the future who may face similar issues without relying on hard forks to do so. This protocol would be open to anyone no matter how large or small or how well connected.

We believe that the EFRP would lower the smart contract malfunction risk for individual users thereby significantly lowering the barrier to adoption of the Ethereum ecosystem. Additionally, having an adequate decentralized resilient recovery mechanism in case the inevitable happens will strengthen institutional confidence to pick the Ethereum ecosystem over more centralized competitors. The EFRP would be a big step towards solving the question of dealing with unintended smart contract interactions without resorting to rollbacks or centralized code interventions that damage immutability.

Economic logic

Currently a significant amount of ETH exists which is compromised, the locked Parity multi sig is a prime example but there are others. These ETH exist on the blockchain like any other ETH, they are not burned but inaccessible. Our proposal would allow the owners of these ETH to self-burn these ETH forever and accept sETH as compensation through the EFRP.

The economic result of this action will be a temporary increase in ETH burn rate, before sETH is distributed the original stuck ETH is burned up front. Over time the sETH will be burned while it is replaced with the base fee currently burned since EIP 1559. When all sETH is burned the base fee will be burned exactly as is done currently. The net effect on Ethereum inflation will be 0 as sETH is only generated by burning an equal amount of ETH in advance through the EFRP.

Since the text was to long the actual proposal follows in the first post.