Hello guys! You can help me with this sequence of questions that I think makes sense not only to answer my questions, but I believe it can help the community to use this protocol to apply real-world functionality!

Without further ado, let’s go to the example:

Assuming that all (Meta)Data) used in this example follows regulatory standards here on

Brazil!

These are.

www.anbima-com-br

These, but not only, are the government entities that regulate the capital markets here in Brazil!

According to anbima files, to create an investment fund you need 3 minimum characteristics.

The Fund. (CNPJ + Various Registration Data)

The Portfolio. (CNPJ + Various Registration Data)

The asset. (CNPJ + ISIN + Various Registration Data)

Each of these entities here in Brazil are considered commercial entities, that is, each of them must have a CPF and an individual to be able to open a commercial entity!

Equivalent identification number BR/USA / Individual Entity (PF) (F)

In Brazil Individual Taxpayer Registration (CPF) Numerical sequence - 804.214.624-85 / In the USA it is Social Security Number(SSN) 565-82-00741

With a valid CPF it is possible according to Brazilian law to open a CNPJ commercial entity

Identification number equivalent to / BR/USA Commercial Entity (CNPJ) NATIONAL REGISTRY OF LEGAL PEOPLE (PJ) (J)

In Brazil CNPJ Numerical sequence - 85.36.671/0001-83 / In the USA it is Employer Identification

Contains all the data to legally create an investment fund.

With the following features.

1 investment fund

With 1 wallet,

With 3 assets,

being;

2 physical assets:

2 commercial buildings for rent for offices.

I chose to use a HYBRID income model for the investor who buys the shares of the fund.

It works like this;

12 Months from the date of signing the contract - For example from the date of the question 09/20/2022 to 09/20/2023

The investor receives 2 types of fixed income, which can be calculated based on the index (CDI)

generally used for the calculation of fixed income investment products in brazil.

Post fixed income that is variable and the IPCA index is generally used to calculate this variable income rate.

Forgot to mention that! In this case! would probably use oracles to fetch this ofchain data.. right?!

This product usually has an expiration date (Maturity) of 12 months.

By bringing such an asset to the blockchain, for example, it is possible to make the investor withdraw his investment whenever he wants. With blockchain the investor can obtain other forms of profit etc…

The data below is fictitious! However, the fields are those required by regulatory bodies.

and business etc.

I also believe that using “real” data and a real world business model helps us when coding a real product.

My question is, could you use the Metadata below and create a complete example?? Where and how would each of this information go?

I ask this question because I’m interested in using the protocol in real products, but of course before testing etc…!

But for that I need examples as close to reality as possible and in this case I live in the Brazilian market!

And of course, if that answer requires a higher level of work, I’m willing to hire your consulting service to help me create a product that could be marketed in the real world. But that it had the characteristics that I describe in this post.

I am aware that the blockchain and its features can lower the total cost of an operation like this that involves CPF and CNPJ / Legal entities.

The beautiful world is where we could use both: blockchain+structured data from regulators etc..!

Because the institutional investor, with a lot of $$$ will definitely opt for a system that uses blockchain but that essentially has solid regulatory foundations in the way it handles data and its financial operations!

I’m willing to help with whatever it takes to see this protocol evolve!

Thank you and congratulations to everyone involved in this Wonderful IEP/ERC! It even seems to open up new horizons for financial services.

Below is the example data.

https://abre.ai/exceldataAttached is the complete spreadsheet:

Trad-PTBRtoING-Layout Fundo - Carteiras Ativos GMAA - Google Sheets

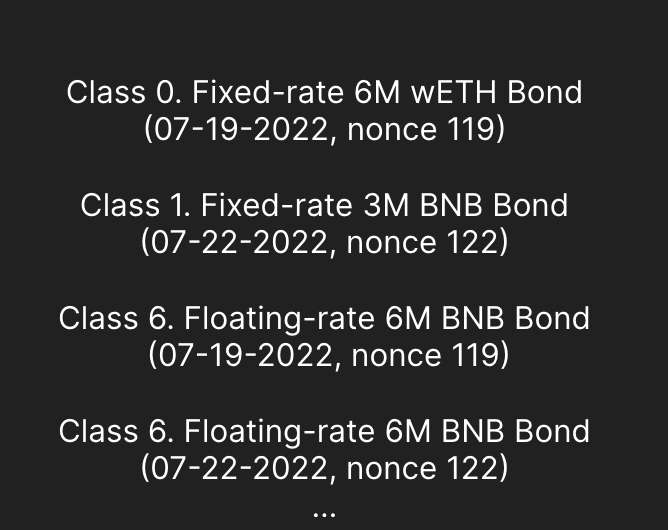

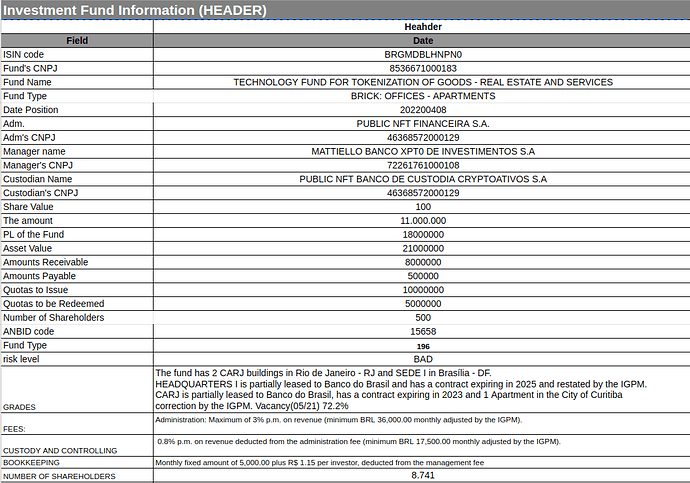

| Investment Fund Information (HEADER) |

|

|

|

|

|

|

|

|

Heahder |

|

|

|

|

|

|

| Field |

Date |

|

|

|

|

|

|

| ISIN code |

BRGMDBLHNPN0 |

|

|

|

|

|

|

| Fund’s CNPJ |

8536671000183 |

|

|

|

|

|

|

| Fund Name |

TECHNOLOGY FUND FOR TOKENIZATION OF GOODS - REAL ESTATE AND SERVICES |

|

|

|

|

|

|

| Fund Type |

BRICK: OFFICES - APARTMENTS |

|

|

|

|

|

|

| Date Position |

202200408 |

|

|

|

|

|

|

| Adm. |

PUBLIC NFT FINANCEIRA S.A. |

|

|

|

|

|

|

| Adm’s CNPJ |

46368572000129 |

|

|

|

|

|

|

| Manager name |

MATTIELLO BANCO XPT0 DE INVESTIMENTOS S.A |

|

|

|

|

|

|

| Manager’s CNPJ |

72261761000108 |

|

|

|

|

|

|

| Custodian Name |

PUBLIC NFT BANCO DE CUSTODIA CRYPTOATIVOS S.A |

|

|

|

|

|

|

| Custodian’s CNPJ |

46368572000129 |

|

|

|

|

|

|

| Share Value |

100 |

|

|

|

|

|

|

| The amount |

11.000.000 |

|

|

|

|

|

|

| PL of the Fund |

18000000 |

|

|

|

|

|

|

| Asset Value |

21000000 |

|

|

|

|

|

|

| Amounts Receivable |

8000000 |

|

|

|

|

|

|

| Amounts Payable |

500000 |

|

|

|

|

|

|

| Quotas to Issue |

10000000 |

|

|

|

|

|

|

| Quotas to be Redeemed |

5000000 |

|

|

|

|

|

|

| Number of Shareholders |

500 |

|

|

|

|

|

|

| ANBID code |

15658 |

|

|

|

|

|

|

| Fund Type |

196 |

|

|

|

|

|

|

| risk level |

BAD |

|

|

|

|

|

|

| GRADES |

The fund has 2 CARJ buildings in Rio de Janeiro - RJ and SEDE I in Brasília - DF.

HEADQUARTERS I is partially leased to Banco do Brasil and has a contract expiring in 2025 and restated by the IGPM.

CARJ is partially leased to Banco do Brasil, has a contract expiring in 2023 and 1 Apartment in the City of Curitiba

correction by the IGPM. Vacancy(05/21) 72.2% |

|

|

|

|

|

|

| FEES: |

Administration: Maximum of 3% p.m. on revenue (minimum BRL 36,000.00 monthly adjusted by the IGPM).

|

|

|

|

|

|

|

| CUSTODY AND CONTROLLING |

0.8% p.m. on revenue deducted from the administration fee (minimum BRL 17,500.00 monthly adjusted by the IGPM).

|

|

|

|

|

|

|

| BOOKKEEPING |

Monthly fixed amount of 5,000.00 plus R$ 1.15 per investor, deducted from the management fee |

|

|

|

|

|

|

| NUMBER OF SHAREHOLDERS |

8.741 |

|

|

|

|

|

|

| Layout for Portfolio Attribute Information ( HEADER ) |

|

| Section Tag |

header |

| Field |

Format |

| CNPJ or CPF of the Holder |

46812995000196 |

| Wallet code |

74133312 |

| Date Position |

20220408 |

| Portfolio Name |

BEEOCEAN NFT DIGITAL REPRESENTATION |

| Kind of person |

J |

| Current Account Code |

01232323000789032 |

| Name of Manager/Administrator |

BEEOCEAN INNOVA SIMPLE |

| Manager’s CNPJ |

46812995000196 |

| Custodian Name |

GMA Digital Bonds CRYPTOATIVOS S.A |

| Custodian’s CNPJ |

46368572000129 |

| PL of the Portfolio |

1800000000 |

| Amount of Taxes |

5000 |

| Asset Value |

1790000000 |

| Amounts Receivable |

5000000 |

| Amounts Payable |

5000000 |

|

|

|

|

| ** |

Layout for Stock Position Information |

| Section Tag |

actions |

| Field |

Format |

| Paper ISIN code |

BRGMDBLHNPN4 |

| CUSIP code |

513569751 |

| Asset Code (Symbol) |

GMAA |

| Available quantity |

21,000,000.00 |

| Batch |

21.000.000 |

| Warranty / Blocked Quantity |

7.000.000 |

| Available Financial Value |

12.000.000 |

| Financial Value in Guarantee |

4.000.000 |

| Amount of Taxes |

50.00 |

| PU Position |

20.00 |

| % Credit Provision |

0.00 |

| Current Account Type |

1 |

| Operation Class |

V |

| Lease Expiration Date |

2022061212 |

| Rent Fee |

3 |

| CNPJ of the Intermediary for Rent |

46812995000196 |

| hybrid income |

CDI (Fixed) + IPCA (Variable) |

|

|

|

|

| ** |

Layout for Real Estate Portfolio Position Information |

| Section Tag |

properties |

| Field |

Format |

| Property address - street |

AÇATURA DE CIMA - PARISH OF SÃO JOSE DOS PINHAIS |

| Property address - number |

52 |

| Property address - add-on |

XPTO - PARISH OF SÃO JOSE DOS PINHAIS |

| Property address - city |

JOSE DOS PINHAIS |

| Property address - state |

PARANA |

| Property address - zip code |

83005010 |

| Commercial name of the property |

REAL ESTATE ENTERPRISES XPTO USE |

| Fund participation in the property |

30000000 |

| book value |

50000000 |

| Justification for book value |

0 |

| Appraisal value |

55000000 |

| Evaluation date |

20220805 |

| Appraiser type |

J |

| CNPJ or CPF of the appraiser |

34783976000108 |

| contracted rent |

450000 |

| late rent |

100000 |

| repurchase option indicator |

s |

| Repurchase option date |

20220805 |

| Property type |

4 |

| legal questioning indicator |

s |

| Reason for legal inquiry |

XPTOUSOCAP |

| Type of Use |

5 |

| registration |

559285432391986 |

| CNPJ of the Enterprise |

60974116000153 |