I’m a little surprised not to see more discussion about some good points people like veox and editor-Ajian have raised above regarding the economics of this proposal.

To put it succinctly, whether this proposal is accepted or not, the price of transactions during a time of congestion is going to continue to be driven by the equilibrium conditions between supply and demand for block real estate. Assume, for instance, that at a time of congestion there are 10x more users in need to submit urgent transactions than there is room for in the subsequent blocks. As is the case now, users will have no choice but to compete with each other, hiking up their miner fees in order to make sure that their respective transactions are executed timely, causing the gas price to go up until all but a tenth of them are priced out, i.e. until the equilibrium between supply and demand is reestablished.

This new equilibrium price is only dependent on the utility of executing a transaction to the individual users, the amount of ether they have to spend, and on the available supply of block space (AKA its gas weight limit). It’s fully irrelevant how we designate the different components of the transaction fee (base fee, miner tip or bribe), the equilibrium gas price during a period of congestion is going to be the same for a given level of supply. Even more irrelevant for the equilibrium price is what eventually happens to the different components of the fee after it leaves the user’s wallet: Whether it’s burned, transferred directly to the miner or pooled in order to create a more stable mining incentive.

That brings me to the aspect of this proposal which IMHO is likely to have a significantly positive impact on transaction prices: The increase of the block gas limit. There is no doubt that greater supply of this scarce resource will alleviate gas price surges during times of congestion, so that’s definitely a welcome improvement that’s likely to benefit most of the community.

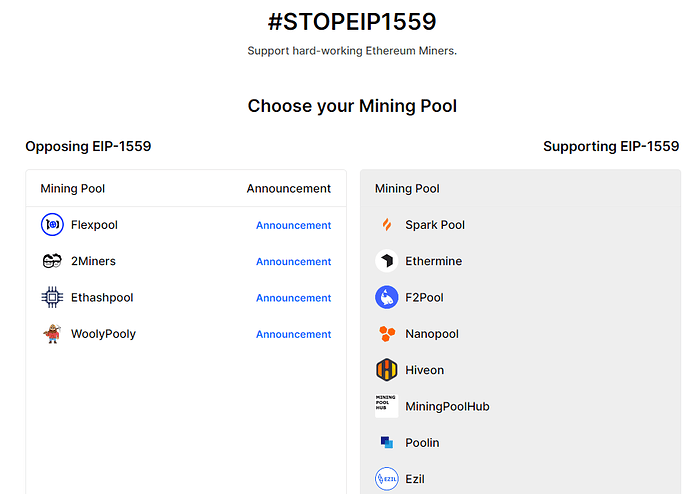

But as @kladkogex and others have pointed out earlier, I fail to see the logical necessity of conflating the increase in transaction capacity (which in itself would likely be acceptable and welcome to most people in this discussion) with a fee structure change (i.e. the breakdown into base fee and miner tip, including a rule for calculating the former built into the protocol which might arguably deviate from optimality) and a monetary policy change (i.e. the decision to burn that fraction of the transaction fee instead of giving it to its current beneficiary). No wonder this has turned out to be rather controversial.

I found @vbuterin 's paper /Blockchain Resource Pricing/ quite helpful to better understand the motivation for those changes, but it still seems unfortunate to me that this is being done as a single all-or-nothing proposal, because each of the points I mentioned above has potentially far-reaching implications (e.g. due to the delayed nature of the base fee computation it can conceivably lead to an increase in gas prices on the average, relative to a network with comparable capacity which doesn’t impose base fees, in stark conflict with the general intention of this proposal) or rely on assumptions that are difficult to verify, either experimentally or in a simulation (e.g. if my understanding is correct the primary motivation for moving away from a gas supply cap in favor of a set gas price seems to be the promise of better economic efficiency under the assumption that the marginal social cost has much lower slope in absolute value than the demand function, this is however exceedingly difficult to test due to the non-linear behavior of the social cost function, and it wouldn’t be unexpected for the opposite to hold true past a tipping point that allows a critical level of centralization to be reached that enables a large-scale attack to be committed on the network, not unlike the behavior of the social cost function of carbon emissions @vbuterin mentions in his article).

If we have reasons to believe that such a catastrophic tipping point won’t be reached within the gas limit range [Wmax,Wnewmax], maybe there is no reason for the increase in block capacity everyone is waiting for to remain blocked by the more controversial/problematic bits of this proposal (Incidentally such a simpler change bumping the gas limit to Wnewmax alone would deliver lower gas fees than this EIP on the average, since no base fee would be imposed to the user anytime).

If people consider that the sudden jump to Wnewmax=2*Wmax would run the risk to overwhelm full node administrators maybe the gas limit could be increased by a more modest fraction while still delivering gas prices close enough to this proposal. Or a simpler mechanism could be implemented to provide the guarantee that the average block size never exceeds Wmax while still allowing comparable elasticity to this proposal, by carrying a running (e.g. exponential) average of the gas usage per block and requiring valid blocks to maintain it below Wmax (which would have a far more deterministic behavior than relying on market feedback mechanisms in order to achieve a similar effect).

Apologies for the long reply, I truly did my best to keep it succinctly, maybe another symptom of too many things going on at once here