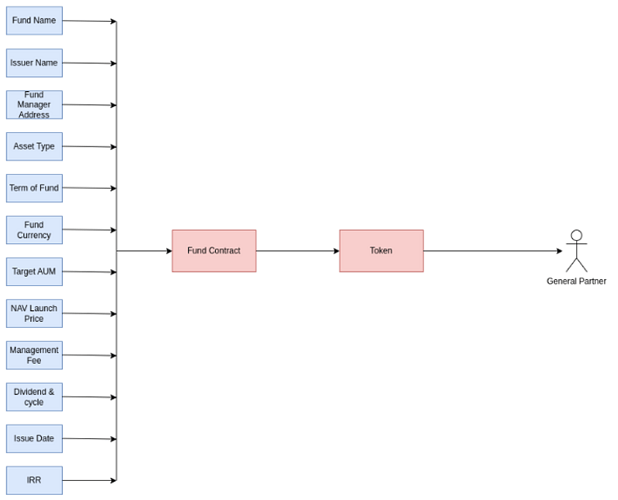

Private Equity Fund Contract

This proposal is for a decentralized approach to managing private equity funds and asset tokenization using a unified standard. In this system, a contract for a private equity fund distributes dividends to users in either stable coins or fund tokens, allowing users to select their preferred option.

This is currently used by Oasis Pro Markets in their tokenization platform. This standard is used to tokenize private equity securities and is based on ERC-3643, on top of which we added multiple layers.

Abstract

A private equity fund is a type of investment fund that pools together capital from high-net-worth individuals, institutional investors, and sometimes, pension funds to make investments in private companies. These funds are managed by private equity firms, which specialize in acquiring ownership stakes in companies and actively managing them to generate returns.

Motivation

The existing investment landscape faces multiple challenges, including high investment barriers, limited liquidity, lengthy settlement processes, regulatory compliance issues, counterparty risks, and concerns over custodial control. These barriers prevent individuals from taking control of their investments, diversifying their portfolios, and accessing the benefits of a secure and efficient investment ecosystem.

There is a pressing need for a comprehensive solution that addresses these challenges, providing a tokenization platform that sidesteps investment barriers, establishes an unceasing liquid marketplace with instant settlement, ensures regulatory compliance, eliminates counterparty risks, and enables self-custody, empowering users to make informed investment decisions, access diverse opportunities, and maintain full control over their assets.

Management Fee

When it comes to compensation, private equity funds typically charge a management fee, which is a percentage of the committed capital, to cover operational expenses. In addition, they also receive a share of the profits generated by the investments, known as carried interest. Carried interest is usually calculated as a percentage of the fund’s profits above a certain threshold, often referred to as the “hurdle rate.”

Dividend Distribution

During the life of the fund, the general partner may occasionally distribute interim dividends to the limited partners, who are the investors in the fund. These interim dividends are typically funded by profits generated from the portfolio companies or from the sale of certain investments. However, the primary focus remains on generating capital gains rather than distributing regular dividends. These dividend distributions can be via stable coin transfer, token minting, or via fiat currency. These distributions are handled within the smart contract itself.

Waterfall Distributions

The waterfall distribution is a common method used in private equity and venture capital funds to allocate profits among the fund’s investors, particularly the general partner (GP) and limited partners (LPs). The term “waterfall” refers to the sequential manner in which profits are distributed. Once the GP has caught up to its specified share, the remaining profits are typically shared between the GP and LPs based on a pre-determined split ratio. Common ratios include the 80/20 or 70/30 splits, favoring the LPs.

It’s important to note that the specific terms of the waterfall distribution, including the preferred return rate, GP catch-up threshold, and profit-sharing ratios, are negotiated and documented in the fund’s partnership agreement. Different funds may have different structures and variations in their waterfall distributions.

The waterfall distribution model ensures that LPs receive a return on their investment and that the GP’s share of profits is aligned with their performance and the success of the investments made by the fund.

Security Considerations

We have considered and used several security measures to our contract standard like access control with different roles along with multi-sig functionality.

Specifications