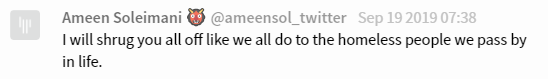

I’m reading through this, but there is not point to debate with someone that is selflessly arrogant. That kinda statement tells me all I need to know with the weight of their influence and position within this ecosystem.

LOL! PRO STATUS QUO

That’s best clown statement I’ve ever heard.

ASIC Resistance IS the status quo for Ethereum.

The drama is what kills Ethereum.

ProgPoW is 100% better every single way.

There’s truly no argument against it.

BUT

What’s worse then staying on Ethash is saying we are switching to progpow every 3 months and never doing it.

If Ethereum would just say “We will never switch to ProgPow we will be forever on Ethash” okay then thats fine at least people can plan around that.

It still would be terrible in comparison to moving to progpow, but atleast there is SOME vision and consistency even if its a shitty one

I feel this is a good compromise and would support it. I’m a little weary about giving the nodes the option of which block height to activate, because that can cause a consensus nightmare and unplanned/unprepared-for network splits. But if we can work around the switch as more of a flagging mechanism than activation mech that could work. A strong signal to help the nodes coordinate, which is typically managed by the ACDs but puts them in a precarious decision on highly political proposals.

I’d like to also relay some of the risks those against ProgPoW are concerned with from my own perspective. This is my own list so anyone else can add if they need:

-

All hard forks carry significant risk of an unclean activation resulting in a a chain split whether they are contentious or not. This is why coordination is so important and having everyone from mining nodes to service nodes on the same page as far as planning and supporting the new chain. I don’t believe we have the coordination to execute this HF cleanly given a subset of the mining nodes cannot support it and have no option but to continue mining blocks under the old rules. Service nodes, like Infura’s, generally take a conservative approach, upgrading at the last moment to avoid any release bugs/issues from impacting them. It’s likely some end up on the ethash chain at least temporarily, causing all sorts of confusion and uncertainty. This is even greater an issue during political HFs as they take a wait and see approach.

-

There will be a chain split. There is no question of that. There is hashrate that cannot upgrade so their will be blocks mined on the prior chain. How long that lasts for is anyone’s guess and is dependent really on there being zero economic incentive to mine it any longer. With that all but certain, there is a high likelihood of opportunists seizing the chance (perhaps in coordination with the ASIC manufacturers) to ensure the chain survives by getting it listed on an exchange. There are very deep pockets involved and the listing fee on many exchanges is relatively small by comparison to the potential earnings (see BCH). If someone paid the “donation“ to Binance, they’d all but guarantee the ethash chain never dies, as speculation can sustain it. Additionally, the state itself is valuable. There isn’t much work needed, if any, to make things like Uniswap just work on the new fork. Thst said, the fork isn’t something we can really prevent now or later on, it’s a permissionless system, but rushing to make it happen now is IMHO not worth the risk of destabilizing Ethereum and pushing projects, users, etc. away due to a loss of confidence.

-

The concerns over the transition to PoS are largely unfounded speculation. ASICs can play information games and fork the chain at any of the upcoming planned forks, but it would not be in their economic interest to do so until the final fork to enable full PoS, as they will still reap rewards from Ethereum through Phase 2 and the migration of ETH 1 state to an EE in ETH 2. It’s more likely they simply sustain the PoW chain following the transition, which, to be honest, is their right as a marginalized party (ETH 2 marginalizes all miners to the point of irrelevance). Additionally, the idea that massive GPU operations will not play similar games or sustain the Ethereum PoW chain post transition is a naive assumption that minority coins or illiquid GPU mineable coins provide a stronger incentive for GPU miners than a fork of Ethereum, with all its valuable state and pre-built dapps/defi infrastructure. If this were the case all minority fork would have no hashrate and be dead on arrival, and we know that’s not the case. So long as some actors have the means and motive to keep the PoW fork alive, it will be valued in the market. To this point I see now reason why we fork now, versus then. If we fork now, it’s likely we will end up with 3 chains come PoS transition, vs 2 if we simply do nothing. Each surviving fork carries the potential to dilute Ethereum’s network effects, as well as place significant burden’s on those developing atop it.

-

The dApp developer / user burden. Every fork of Ethereum in which the prior version does not die, carries a burden for those building atop Ethereum. I would ask everyone to read Alex Van de Sande’s piece on that subject: https://medium.com/@avsa/avoid-evil-twins-every-ethereum-app-pays-the-price-of-a-chain-split-e04c2a560ba8

This sums up my primary reservations with the ProgPoW fork in general.

If we can find a workable compromise, such as what Ben has proposed, I think it’s worth analyzing.

This might be the strongest argument against any change in our hash function. It might also be the strongest argument against ASICs, as they will cause any upgrade they cannot follow to cause a split. This might also be a reason to pay the price of fighting them now before it gets any larger. (This applies to any other part of the protocol that ASICs freeze in hardware.)

Split is exactly what we need. Ethereum needs to innovate and improve - people can create as many legacy Ethereum versions as they want. They will never be more than ethereum classic 2.0 3.0 4.0 whatever.

Ethereum has to innovate or it will continue to die out

Let the ASIC miners have a circle-jerk on their own tiny little chain with a market cap of $0 because no one uses the coin.

The ONLY thing that drives coin value is coin usage. That’s why BTC is an order of magnitude more valuable than ETH.

Monero have forked 80% ASIC hash from their network, more than once. I am not aware of a Monero ASIC fork that survived. Why would Ethereum be any different to Monero?

Very true - Monero is a great success story of a coin that despite very little awareness and utility still retains almost a billion $ in value on pretty much the basis of its asic resistance alone

ASIC manufacturers are mining on millions of ASICS right now.

You must be rational and ask - why on earth would a company sell an ASIC miner if they can just mine themselves.

The only reason they would sell is if they feared progpow.

Everytime progpow comes around Linzhi is about to deliver.

They’ve been mining for years now and are making bank during this recession.

I really think something like a New Social Governance Layer for Ethereum could be helpful in discovering community signal on the ProgPOW debate.

I think there needs to be a way to qunatatatively gauge the numbers surrounding what the community thinks about the issue so that core devs can make the most informed decision possible.

How can one decision or another effectively be made if the current tools we have to gauge sentiment on the issue are inadequete?

Having more data to back the decision would lend validity to whatever decision ends up being made (I have no opinion on what decision should be made, just want to create a system where sentiment on topics like these can be quantified for the core devs).

Seriously, the manufactures are making money hand over fists with these ASICS. I’m almost scared to see how bad it really is as far as mining centralization.

I remember when monero forked it’s ASICS off for the final time. Hash went down like 90%+.

Is that what we want? To be dominated by a few manufacture? Sounds super centralized to me .

The Ethereum ASIC manufacturers are making billions dumping the coin. They mine well over 90% of the hashrate.

Greatest irony is that all the asic proponents thought they would be part of the game, but they are not