The fact of the matter is that there are piece of hardware designed specifically for mining ethereum that far exceed the efficiency of consumer grade hardware.

These ASIC manufacturers are not publicly listed companies, and they operate with no oversight.

The fact that there is so much unknown is a symptom of the problem.

Everyone knows that ASICs are running the game right now. It’s like not even worth having a discussion about that, because that’s arguing just to argue.

I really really can’t understand why someone who is not an ASIC manufacturer would ever support ASICs.

Is it because they can somehow ‘beat’ the game and get an ASIC that no one else gets? Seriously are people that naive?

IDC about prog pow. What I care about is making it so that the playing field is fair, and openly understood. This is only possible with GPUs.

Additionally, no regular people use Ethereum anymore.

The grandma and grandpa buy bitcoin. And the gamer mines monero.

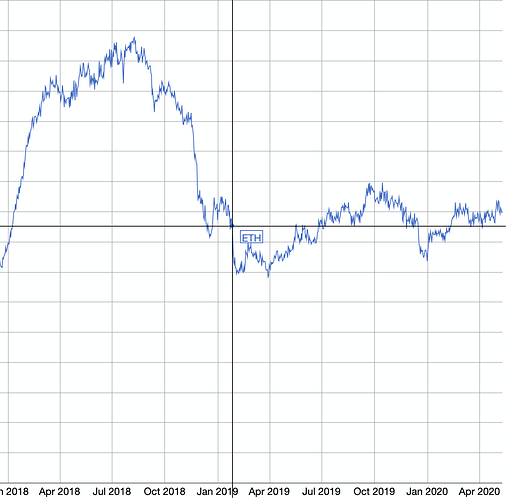

Ethereum is dying (20% loss to BTC over the year).

Ethereum has every reason to grow and succeed and destroy bitcoin. It has the momentum, but because of bad governance particularly around ASIC resistance it is actually losing.

20% might not sound like a lot, but it only takes a few years like that and this thing is bigger shit coin

Truthfully, I have no problem with people making money. But unless you’re actually the asic manufacturer you’re going to lose big.

ProgPOW drives me nuts because it isn’t even like a confusing thing. It’s literally the world vs the asic manufacturers. Yet there are so many people who have been convinced to support ASICs. Truly stuff like this makes me think Ethereum will never make it.