Thanks for this helpful summary, @AlexeyAkhunov. On the first points only, regarding uncle rate and gas limit:

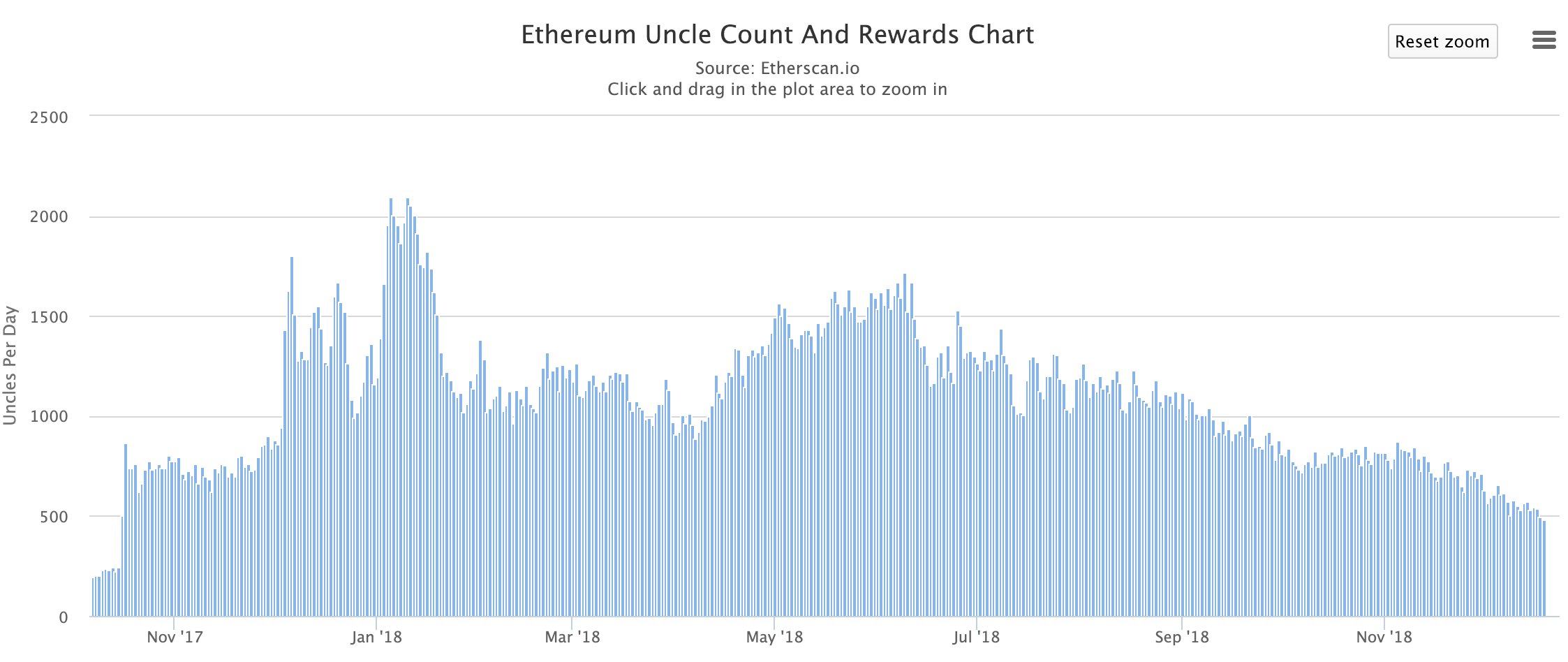

The uncle rate has been trending downwards for some time, and continues to trend downwards. The Parity optimization is likely one factor, but the downward trend began much earlier, which suggests that there are other factors such as mining centralization, overall decline in network congestion, and maybe other improvements in connectivity/decreases in latency.

Based on Vitalik’s math in this article, and the fact that the uncle rate has declined by more than two-thirds over the past few months, if there is an increased likelihood of 1.86% of an uncle block for each additional million of gas added to a block, we could in theory raise the block gas limit by as much as 20-30 million and expect to end up back at a similar uncle rate as before. This is very naive math, and the relationship is likely not linear beyond a certain point; also this analysis was performed was two years ago so it would be nice to revisit it with more recent data. Obviously, we probably do not want to implement such a dramatic gas increase in the short term. But the point stands that it’s theoretically possible on the back of this data alone. We should discuss this, and consider a smaller increase.