This isn’t true. EIP-1789 still isn’t finalized but it will include zero rewards to start so no one benefits at anyone else’s expense. There will be a separate EIP to turn on the rewards, and we don’t know yet whether they will come out of mining rewards.

Calm down and read what I wrote again. I said: “it is about the ability to not trust a third party for transaction confirmations”

No, it is absolutely clear, well documented and proven. Do your research.

Zero responses because at this point, you’re just trolling.

To be fair, can you provide a source on this?

How about the fact that Linzhi is the only company currently saying that they are creating an ethash ASIC (once again… both Bitmain and Inno are no longer selling an ethash ASIC to the public).

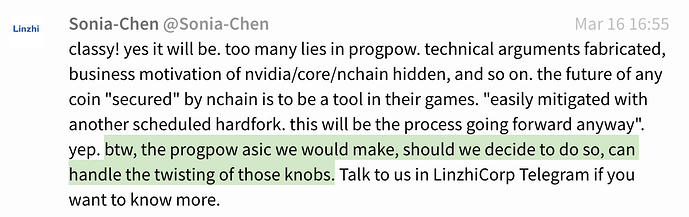

Yet, they are actively campaigning against ProgPoW (of course, it’ll cost them a lot of money!), while at the same time saying that a ProgPoW ASIC will be easy for them to create. All through anonymous accounts and they barely even have a website and a whopping 10 employees.

It seems pretty risky to be betting a $14b market cap on a company like that, no?

Furthermore, I cover the risks of centralization on ASICs in my post.

I definitely agree with your viewpoint, but I think this is more opinion based on observation than “well-documented and proven”.

We simply have too few data points to demonstrate that as fact, one way or the other.

This isn’t opinion, everything I said is facts.

- Name one other manufacturer producing an ethash ASIC.

- Who is Sonia Chen? Nobody knows.

(edited my response here because I didn’t get your concern at first)

So you’re worried that this 10 person company that you think is sketchy is going to completely take over the Ethereum mining landscape? I suppose it’s an understandable worry, but I don’t think it falls under the category of a well documented and proven risk.

Yet, they are actively campaigning against ProgPoW

And GPU miners are campaigning for it. It’s natural for a business to campaign against a rule that essentially pushes them out of a market. This shows that an ASIC manufacturer is self-interested, but you haven’t shown that risks from ASICs is “well documented and proven.”

while at the same time saying that a ProgPoW ASIC will be easy for them to create

Where specifically is the harm to Ethereum from that statement?

I looked at your post about the risks of ASICs and did not see any well documented and proven risks, except possibly this one:

ASICs are a dead end. When they are unprofitable they become e-waste

Which is a risk to the environment, not a risk to Ethereum.

If Linzhi can produce an ASIC that is 7x more efficient than a GPU, yes. It means others can as well and they will likely not do it in public. This has happened on other smaller coins already, Monero is one.

The COMMUNITY is campaigning for it. See the signals from the carbon vote, twitter polls and hash rate vote.

The harm is the self interest. For example, Bitmain mines with equipment before shipping it out. Linzhi will only sell to select customers. When you get into an ecosystem where self-interest drives things, that is centralization that we are trying to avoid. On the other hand, GPUs don’t have these self-interest issues.

The creation of FUD that is specifically designed to delay or stop ProgPoW from happening so that they can build and release their ethash ASIC which is claimed to be 7x more efficient than GPUs.

Ask yourself WHY the miners are campaigning for ProgPoW.

It is because it levels the playing field. A level playing field is a good thing for the eco-system.

ASICs and their manufacturers harm the eco-system by selectively selling equipment to the highest bidder at whatever price the market will bear.

Remember, they could just build and mine themselves (and they do by competing against their own customers), but it is WAY more profitable to sell them.

GPUs can be bought on an open market by any one.

When there is an event that happens which makes mining with your ASIC obsolete, your investment becomes a total loss. With GPUs, you can mine other things. That puts intense political pressure on maintaining the status quo. We’re already seeing it here, and it will only be worse when they are more prevalent.

The migration to PoS is one such event that is planned. Hybrid PoS/PoW is another. There is intense FUD being spread to keep the status quo, and that’s even before there is significant enough of the hashrate controlled by ASIC interests. Remember 77% of the hashrate voted yes to ProgPoW, which pegs the total at most 23% (probably more like 5%).

The COMMUNITY is campaigning for it. See the signals from the carbon vote, twitter polls and hash rate vote.

IMO the hash rate vote should not factor in too much because assuming that the network is now dominated by GPU miners, it’s asking an incumbent whether they want to disallow competition.

The coin vote also represents a little less than 3% of all coins. It’s definitely more interesting than the hash vote but the low voter turnout should not make it decisive. Specifically note that if ProgPow harmed Ethereum in such a way that a harm was distributed among the entire community but benefits were concentrated in a special interest group, you’d expect coinvotes against it to be underrepresented because the members of the special interest individually have a lot more to lose/gain than an average member of the community, and are therefore more likely to take the time to vote. This is why special interests are able to get laws passed in their favor in democracy: normal citizens don’t have the incentive to get worked up about every little thing that does them a little bit of harm.

The twitter polls I have seen are much more evenly split, but Twitter polls generally suffer from the problem I described above too. The camp that benefits in a more concentrated way will have more incentive to game the poll.

This is the only sybil resistant twitter poll I’ve seen: https://tennagraph.com/eip/1057

In this poll there are 20 “influential” people in ETH. Only 20% of them favor ProgPow, 50% are against it, and 30% neither favor or are against.

The harm is the self interest.

The pro-ASIC arguments acknowledge that miners are self-interested, but denies that this leads to any bad outcome for Ethereum. If you can’t show how self interest would end up harming Ethereum you haven’t addressed the arguments.

On the other hand, GPUs don’t have these self-interest issues.

GPU miners aren’t self-interested? Your argument suggests that ASICs are less evenly/fairly distributed than GPUs. That’s might lead to actual harms, but you haven’t shown how it will.

Lots of other coins have ASICs. Are there any concrete harms you can point to from them? “Miners are centralized on coin X” isn’t a concrete harm. Concrete harms are things like actual 51% attacks or censorship.

When there is an event that happens which makes mining with your ASIC obsolete, your investment becomes a total loss. With GPUs, you can mine other things. That puts intense political pressure on maintaining the status quo.

This cuts both ways. The fact that a PoW change would make ASICs obsolete is the thing that makes attacking with ASICs so costly. An attacker that builds an ASIC farm to attack Ethereum will lose billions of dollars. An attacker who builds a GPU farm to attack Ethereum will lose much less because their mining hardware is still valuable.

Do you disagree that it costs less to attack a GPU mined currency than an ASIC mined one?

That puts intense political pressure on maintaining the status quo.

The crux of the disagreement seems to be about how much political clout ASIC miners actually have. What is your evidence that resistance to ProgPow is coming from people with ASIC mining interests? Linzhe seems to be the only one making any noise about it.

Look at the only Sybil resistant poll that I’m aware of: https://tennagraph.com/eip/1057

What I see are a lot of people with good reputations in the community who don’t have conflicts of interest making principled objections. People like:

Luis Cuende (CEO of Aragon)

Hayden Adams (Creator of Uniswap)

Evan van Ness (runs Week in Ethereum News)

Ameen Soleimani (CEO of Spankchain)

Martin Koppelmann (Founder of Gnosis)

Ryan Sean Adams (Founder of Mythos Capital)

Phil Daian (crypto researcher)

Georgios Konstantopoulos (plasma researcher / Plasma Cash)

Eric Conner (host of Into the Ether podcast)

These are all people who have come out publicly against ProgPow. How do you explain that? I don’t think you can explain that by claiming that ASIC manufacturers are putting political pressure on them or that they are falling victim to (or propagating) “intense FUD”.

See my previous post about why we the hash rate vote is not very meaningful.

Yes, the costs are the same. The likelihood is what the argument is. It may be slightly more likely to construct an attack with GPUs, but that effect is basically entirely washed out by the relative market cap of the respect chains. 51% against ETH is way less likely than against Grin or ETC, just due to the difficulty. The strongest chain (with a particular PoW algo) always wins.

I would argue that the “self-interest” of GPU miners is known, as they are the incumbents, so it’s a sort of “prefer the devil you know to the devil you don’t” conundrum. The “status quo” would allow a relatively unknown actor into the Ethereum community, with a more complex and possibly counter-active set of incentives, which is more likely to be exploited due to the central power of that actor and cause network disruption at key points. We can point to Bitmain as an example of this.

The parties you mentioned are well-known members of the community, and if that’s all you need to be convinced I suggest you take a closer look at their arguments instead of just relying on their reputations.

To my knowledge, the most interesting and helpful argument that could be construed to be against ProgPoW is from Phil Daian. That post is here:

https://pdaian.com/blog/anti-asic-forks-considered-harmful/

His conclusions are simple: PoW have inherent economies of scale built in, which are impossible to remove. PoS is the only potential mitigation for these faults. Working on “anti-ASIC” PoW algorithms is thus a waste of time for anything but a short-term gain.

I don’t want to put words in Phil’s mouth, as I respect him and his work very much, but I don’t think he would consider himself a hardware expert. His research is primary in code security and smart contract development, although he has a wealth of experience and observations that would be foolish not to take into consideration. At the core of his argument is this point: “anti-ASIC” PoW algo changes are a waste of time as a long-term solution.

ProgPoW is not intended as a long-term solution. It is intended as a 1-2 year stop-gap measure that should even the economies of scale between ASIC manufacturers and GPU miners (who mine with commodity hardware). It is used to help us get to PoS or a Hybrid PoW/PoS option, which will be possible in about 1-2 years when we are confident in the operation of the Phase 0 Beacon chain.

You can make up your own opinion with this information, but I think you know mine. I respect your right to have a different opinion in this regard.

The rest of the people mentioned, to the best of my knowledge, have one or more of the following arguments:

- Phil’s point on anti-ASIC algo changes (we discussed this above)

- “It’s a waste of precious developer time” / “It’s a distraction from ETH 2.0 / PoS schedule” (most work is done)

- “It’s contentious, therefore we shouldn’t do it” (circular argument)

Please correct me if I’m wrong, but these are the only arguments I have received from these prominent community members.

To address 2) Most of the work is already done. The rest of the work is planned because enough people want to see it happen. The teams involved are largely completely different. The only real distraction is the involvement of this proposal into a scheduled hardfork, which considering this EIP is the most complete of any proposed for Istanbul isn’t really a great argument.

To address 3) This is a circular argument. “Contentious” means people disagree. If they disagreed for technical reasons, we should answer those concerns and resolve them, absolutely. If they disagreed because they have a different viewpoint (such as Phil’s conclusions), then we can debate and come to consensus on which way is best for the network. I am very open to this. If they disagreed because other people disagreed, because other people disagreed, then we are all participating in a circular argument, wasting people’s time, mental health, and “social capital” by continuing to debate this important change.

Since proponents believe strongly that this makes the network better, and detractors have few if any real arguments against it (besides the fact they don’t like it), I would suggest that the onus is on the detractors to raise technical concerns (to make the proposal as robust as possible, or show an un-fixable flaw), or to help come to consensus on these less fact-based arguments and opinions that are difficult to resolve so we can put this issue to bed. We currently have no forum for doing this sort of discussion, at least none that resolve with any real certainty, so this is a difficult thing to do. But I would argue that if we cannot do this (discuss and resolve contentious issues like ProgPoW) with any sort of final certainty, we will be royally fucked when more complicated proposals come though. This proposal is fairly straightforward, and good opportunity to experiment with solutions for this critical problem. (Hint: no other blockchain project have solved this either)

Dude, you’re officially a troll.

Come on man, leave the name calling to the Twitter threads lol

It isn’t name calling. If his whole argument is that ETH should move to ASICs because “Lots of other coins have ASICs.”, then that is straight up trolling.

He keeps asking for all these “concrete proofs”, they keep getting provided and then he asks for 10 more. It is circular discussion that is just a waste of time, also known as trolling.

Finally, creating multiple posts here in Magicians to effectively discuss the same thing? Trolling.

People seem not to know that Eth 2.0 development is largely divorced from Eth 1.0 development. So even if none of the client teams had started coding yet their argument is like thinking that nine women can produce a baby in one month.

No community at all has resolved the problem of coming to consensus with final certainty. If final certainty is needed you can move from consensus to voting, dictatorship, or the flip of a coin.

Nonetheless, I’d argue that the core devs have done a good job with this issue, with our main problem being that we did clearly state and communicate the consensus we reached back in early January. We do have forums and processes in place for discussing and resolving these issues, and they were extensively used. We need to work with the community to use them better, and provide better forums as needed, but whether that can stop this kind of after-the-fact outcry I don’t know.

And my opinion remains that things like carbon votes and tennagraphs of “influencers” in birdshit-land are indeed “a waste of precious developer time.”

For that matter, there is C++ code I should be working on now ![]()

Yes, the costs are the same.

I’m really surprised that you claim this. On the one hand you point out that ASIC manufacturers will completely lose the value of their hardware if a coin switches PoW on them (or if they successfully destroy the only coin that the ASIC can mine on). With GPUs you can attack a coin to death and still have very valuable GPUs. Given this, how can you say that the attack costs are the same?

Do you agree that to the extent that you can rent hashpower to attack a coin, that’s cheaper than building or buying the capacity to attack it?

but that effect is basically entirely washed out by the relative market cap of the respect chains

I’m not sure why talking about market cap is relevant because we’re considering different PoW algorithms for the same chain. The relevant question is: If Ethereum still had a ~15 billion dollar market cap but was entirely ASIC mined and was by far the biggest coin mineable with that algorithm, how would the cost to attack it compare to the cost to attack it today?

with a more complex and possibly counter-active set of incentives, which is more likely to be exploited due to the central power of that actor and cause network disruption at key points. We can point to Bitmain as an example of this.

There is some effect here going in the direction you want: if there are fewer people controlling more hash power, it’s easier for them to coordinate to censor/attack, and easier for governments to pressure them.

There is also an effect going in the other direction: if ASIC miners have more to lose from an attack / censorship than GPU miners do (which it seems like you don’t believe, but hopefully I can convince you), then they will be less likely to ever want to engage in an attack / censorship.

Can you point to any direct harm that Bitmain has caused? As in my discussion with Jon, I’m looking for things like attacks, censorship, etc. “Having a lot of hashpower” might be scary to some but is not a direct harm.

His conclusions are simple: PoW have inherent economies of scale built in, which are impossible to remove. PoS is the only potential mitigation for these faults. Working on “anti-ASIC” PoW algorithms is thus a waste of time for anything but a short-term gain.

Daian also spends a significant portion of the article arguing that ASICs make coins more expensive to attack. This is the same thing I’ve been arguing here, the same thing that Joseph Bonneau argued in his CESC18 talk.

IMO this point is a major crux of the debate, so if you or others here don’t accept it we should focus on that.

You mention that Daian is not a hardware expert, but that’s not relevant to the economic argument about why GPU mined coins are cheaper to attack than ASIC coins.

I agree with you that “it’s contentious because it’s contentious” is a thing that happens in other cryptos (Bitcoin) and we shouldn’t let it happen in Ethereum.

The centralisation of hash power makes it much easier for them to attack the chain. It also makes it easier to use coercion to attack the chain since there are fewer people to coerce. It seems to me that it would be better to make it harder to attack (via more decentralised hash power) than to just depend on incentives (especially given the coercion potential).

If his whole argument is that ETH should move to ASICs because “Lots of other coins have ASICs.”

You are not understanding my argument. Pointing out that lots of other coins have ASICs was meant to highlight your inability so far to point to any concrete instance of harm (an attack, censorship) by ASIC manufacturers or miners.

He keeps asking for all these “concrete proofs”, they keep getting provided and then he asks for 10 more

I have not seen you provide any. If you think you have, then I don’t think you understand what I mean by concrete harm. Our conversation reminds me of this:

Bob: “We gotta pass a law to keep people from carrying concealed weapons – someone could get hurt with all these guns everywhere!”

Carl: “Maybe, although some people claim allowing concealed weapons actually increases safety. Is there an example you can cite where someone with a concealed weapon shot someone?”

Bob: “Yeah – Alice definitely has a gun and I’m pretty sure she was walking around the park with it yesterday!”

Carl: “No, I mean an actual harm – is there an instance where someone got shot?”

Bob: “For sure! I heard that Eve actually has three guns, and she’s planning on buying two more guns. Can you believe that? We gotta do something!”

Carl: “You keep pointing to things that you think will lead to harm, but you haven’t pointed to harm yet. What’s an example where someone got shot?”

…

etc.

Since you keep insulting me and since it seems our subthread here isn’t very productive, I don’t plan to respond to you further unless I see some large benefit to the rest of the thread.