I can’t believe nobody is talking about this. The consensus among economist is that low steady inflation is best for a currency. Deflation leads to inefficiencies and increases the chances of a liquidity trap.

A boon of cryptocurrencies in general (and arguable the reason of the recent impulse) is that we are independent from the central banks and their bipolar monetary policy of “print money whenever we feel like it”.

With EIP-1559, we go from the current predictable declining inflation (nearly ideal), to sheer uncertainty where inflation/deflation is the outcome of an unknown function of the network congestion over time.

That is a terrible monetary policy! As ethereum gets more popular, the burnt basefee increases, which causes an increase in deflation, so users are incentivized to not spent their ETH on DAPPs.

It essentially puts a hard asymptotic cap on Ethereum’s economic growth.

If you read all the crappy medium blogs written by proponents of this EIP you will find no sane economic rhetoric to support this change. What you will find is giddy propaganda talk such as "This is great for people holding ETH!!" or “If you hold ETH, you receive BASEFEE indirectly!!!”. Pure populism to convince the layman holder. Advocates of this EIP seem to have dollar signs (or rather, ether signs) for eyes and, as such, have no problem damaging ether’s usability as a currency as long at it pumps their bags.

The EIP sends an incredibly weak economic signal: plain ETH holding must be artificially incentivized using a deflation ponzi (else people might sell their ETH for dollars or euros, oh no!). The side effects being of course that the number 1 ‘product’ that is purchased using ETH (gas for smart contracts) is now less attractive and general use as a currency is discouraged (compared to those dollars and euros).

Make no mistake, being the first mover with smart contracts is the only thing that gives Ethereum any real value. The attractiveness of using a given cryptocurrency as a store of value is directly proportional to it’s name recognition and stable monetary policy. Bitcoin is orders of magnitude ahead on the first and, after this EIP, will also have the advantage on the second.

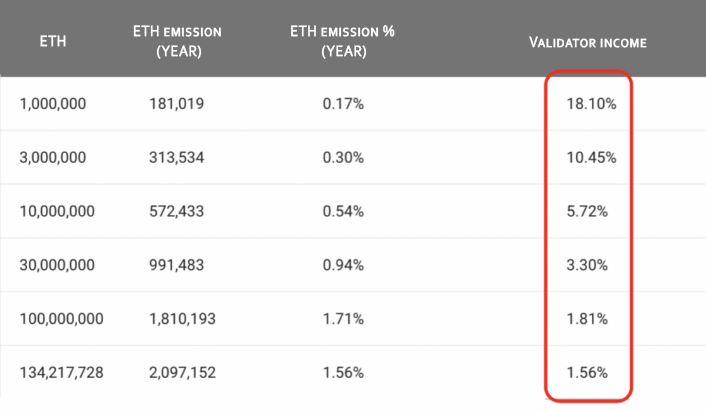

The worst part of this proposal is that there already exists a reward mechanism for people wiling to hold ETH, it’s called staking (rings a bell anyone?). As long as rewards for staking are sufficiently higher than inflation (which they are) there is absolutely zero need for an unconditional incentive to hold ETH. The only people that stand to benefit are those that have no plans to lock their ETH in a long staking contract but instead hold ETH short term with the hope of converting it to fiat when the price has risen enough: soulless traders and speculators looking for a quick buck instead of a monetary revolution.